Register to become a member of The Tile Association and enjoy a number of benefits.

Our members meet high standards of service and quality, meaning that you’re in safe hands. Use our member locator below to get started.

Here are a few of the many benefits when joining TTA.

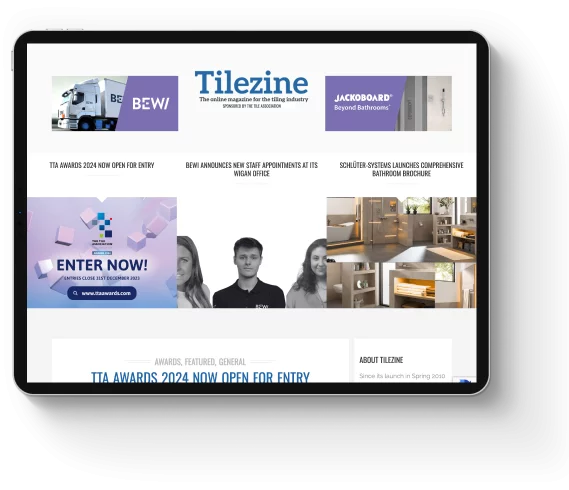

Tilezine is the online magazine for the tiling industry, where tiling professionals go to read the latest industry news. Featured stories range from product information and project updates, to company news and more.

Read Tilezine

A TTA Award is a symbol of excellence and the annual event is a fantastic networking opportunity for all involved in tiles and tiling. There are 16 award categories to enter, plus a wide range of sponsorship packages to get your business noticed.

Book tickets!

The Tiling Show will take place on Friday 10th May at Hilton Birmingham Metropole from 10am- 4pm, it is the UK's only trade show devoted solely to tiles and related products. Be sure to save the date for this must-attend event. Exhibition space is available to book now!

Register to attend!

Need a specific tile service? We can help help find a specific service.

Find a service

Struggling with tile inspiration? Find great ideas for your home.

Get inspired

Use our guides to find out why tiles are suitable for your next project.

Choose tiles

The Tile Association has introduced a new Tiling Guide. This 28-page booklet includes help and support for tilers in their day-to-day work.

Download Guide

TTA regularly communicates the latest industry developments via our newsletter. Find out the latest information on our activities here.

Read TTA's latest newsletter